Retainage (often called retention) is a percentage of the amount certified as due to the contractor on an interim invoice and is deducted from the amount due and retained by the client.

Primarily used for commercial contractors, the purpose of retainage is to ensure that the contractor properly completes the activities required of them under the contract.

The Retention invoicing calculation only functions on Progress Payment or Request for Payment invoices. It is not compatible with Line Item invoicing.

To enable retainage in iPoint:

- Make sure there is a liability account in QuickBooks for retention. This is often an “Other Liability” account.

- Verify that the account has been synced to iPoint in Settings > QuickBooks > Chart of Accounts. If not, sync the account.

- Create an item in the items module. (Inventory Type: Other Charge – make sure QB account is Retention from step 2)

- To enable retainage in iPoint go to Settings > Module Settings > Proposals > Accounting Tab. Check the Enable Retainage Tracking check box.

- Set the retainage item below the checkbox as the item that will be used to track the retainage (from step 3)

The following changes will now take place.

From the Sales Order > Billing (tab) > Billing Options button

- A field used to designate the % to be used for retainage

- A button labeled Invoice Retainage will allow you to create an invoice for all retainage amount held to date

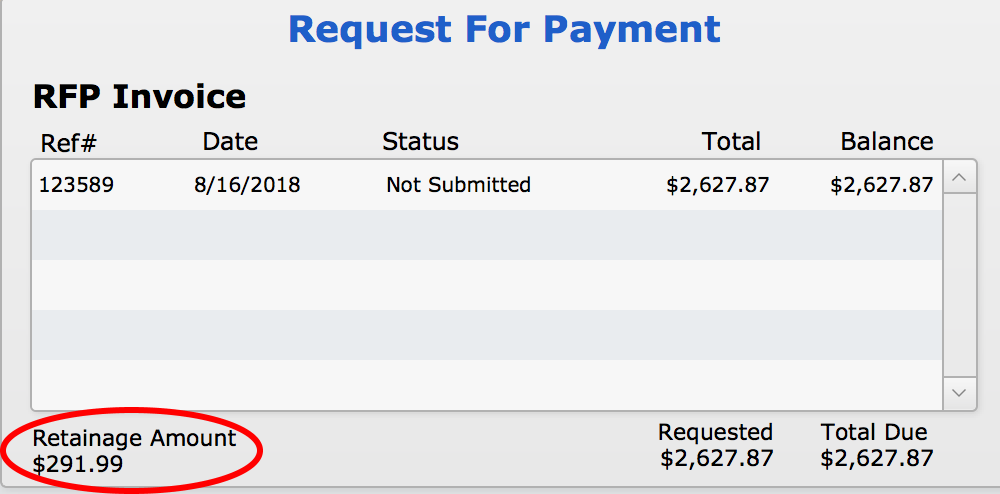

- Below the invoice portal on the left side, the retainage balances will be displayed.

- When creating a progress invoice or a Request for Payment (RFP), the invoices will automatically add an additional line that reduces the balance of the invoice by the retainage percent.

- That total is tracked and displayed as shown in the image above.

- To collect the retainage, select the button labeled Invoice Retainage, and you will end up with a new invoice for the amount of the entire Retainage balance withheld to date.

Last modified:

4 Oct 2024