Delivery Invoices are only created from Sales Orders when utilizing one of the RFP (Request For Payment) billing methods. Delivery invoices are internal invoices and are not intended to send to customers. That is the reason there is a separate view of delivery invoices. All customer-facing invoices are viewed in the Invoices List. In addition, internal Delivery invoices are displayed here. (Yes, we know we just repeated ourselves, but it is important to understand that Delivery Invoices are not sent to customers.)

Note: Did you get the fact that we think it is important for you to understand that delivery invoices are internal documents and not sent to customers? Good!!!

The purpose of the delivery invoice is to track the goods and services that have been physically delivered to the customer. When pushed to QuickBooks, these invoices adjust inventory levels, recognize revenue, relieve customer deposits, and calculate sales tax due.

Other than the fact Delivery Invoices are created only on sales orders and are internal only, they look and function like regular invoices. So, rather than rewrite how invoices work, we’ll refer you to the Invoice section of the manual.

Apply Credits to Delivery Invoices

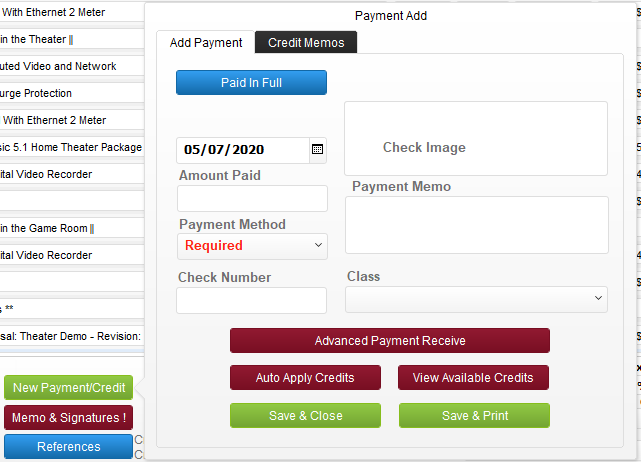

One unique feature of RFP delivery invoices deals with the Auto Apply Credits button. Auto applying credits to a delivery invoice will only apply credits that have been made on the related Request For Payment. In other words, if a customer makes a payment on Sales Order A and Sales Order B, only payments from Sales Order A will be available as credits on delivery invoices for Sales Order A. Payments made against Sales Order B will not be available to claim on Sales Order A

Using a Credit Memo to Balance Delivery Invoices

In a world where your clients pay timely, this options would never be needed. You would always have more money from your clients than the goods and services you’ve delivered to them. In this scenario, when you create the delivery invoice, there are funds to pay it off right then and there. So iPoint will add a negative line item to the delivery invoice that “pays off” the delivery invoice and the balance would be $0. It would look something like this:

December 1: You send an RFP to your client for $10,000

December 5: Client pays $10,000

December 15: You install $10,000 worth of parts and labor

December 18: You create a Delivery Invoice for the $10,000

December 18: iPoint applies a negative line item on the Delivery Invoice for $10,000 (the amount the client paid you) to balance the Delivery Invoice to $0 due

Unfortunately, we don’t live in that perfect world, so let’s talk about another scenario and your options.

December 1: You send an RFP to your client for $10,000

December 5: Client pays $8,000

December 15: You install $10,000 worth of parts and labor

December 18: You create a Delivery Invoice for the $10,000

December 18: iPoint applies a negative line item on the Delivery Invoice for $8,000 (the amount the client paid you) to balance the Delivery Invoice to $2,000 due

January 5: Client pays remaining $2,000

January 5: You apply the new $2,000 on the Delivery Invoice and iPoint applies a negative line item on the Delivery Invoice for $2,000 to balance the Delivery Invoice to $0 due

THIS LAST STEP IS PROBLEMATIC!

Why? Because the payment was made on a new month and a new year, but QB only sees it on the December 18th Delivery Invoice. This can throw of your end of month and end of year accounting.

To avoid that problem, iPoint recommends that you use a credit memo to satisfy that final $2,000 Payment. This would look like this instead:

December 1: You send an RFP to your client for $10,000

December 5: Client pays $8,000

December 15: You install $10,000 worth of parts and labor

December 18: You create a Delivery Invoice for the $10,000

December 18: iPoint applies a negative line item on the Delivery Invoice for $8,000 (the amount the client paid you) to balance the Delivery Invoice to $2,000 due.

January 5: Client pays remaining $2,000

January 5: You apply the new $2,000 on the Delivery Invoice and iPoint will create a credit memo for the $2,000 and apply it to the delivery invoice

You do the exact same steps, but iPoint jumps in and knows to use a credit memo so the dates are accurate in your books. The credit memo will go into QB with a January 5th date and all will be well.

Why don’t I just use a credit memo every time?

You absolutely can, but that’s a LOT of credit memos and would likely make your books quite messy. This scenario should be quite rare as most companies are getting enough money ahead of time to cover their goods and services before they deliver them.

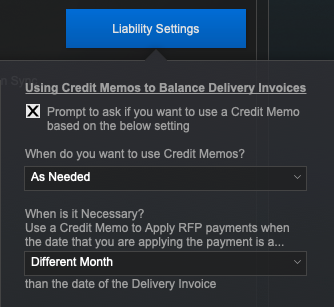

OK, so what settings should I select?

We’ve pre-loaded you with our default settings that are:

Prompt to ask if you should use a Credit Memo

This is just so you know something is going to be different about the payment you are applying, feel free to turn this off if it’s annoying

Use Credit Memos As Needed

This is so you can pick the rules of when you want to use a credit memo instead of a negative line item

It’s Necessary when you are applying payment on a Different Month than the date of the delivery invoice

If you are very particular you can select on a Different Date, but most companies don’t need that level of granularity and just need the books to be accurate month to month.

.

.

.

.

.