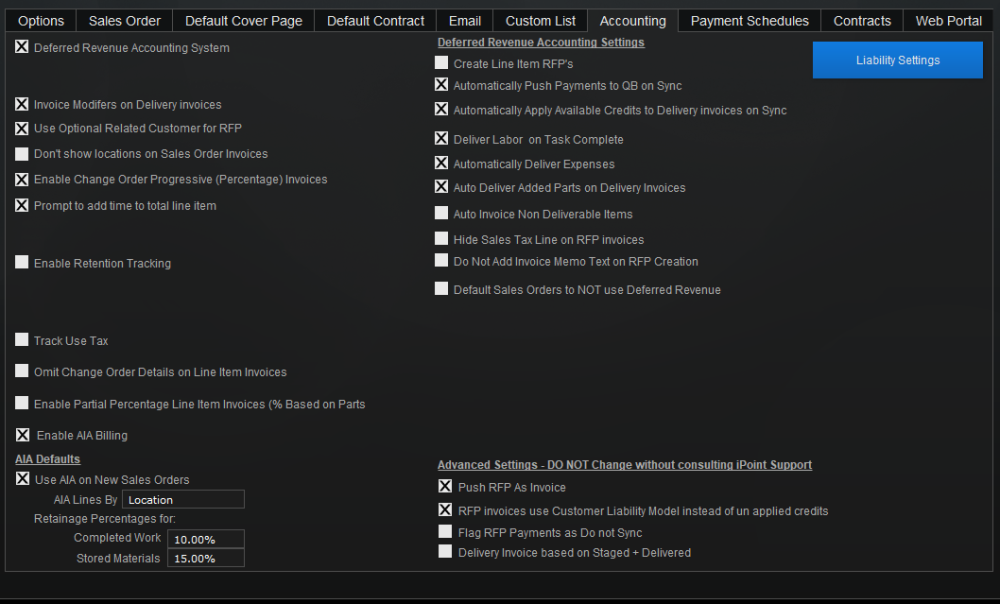

The Accounting tab of the Proposal Module Settings defines how your company will generate invoices. While many setting options define how iPoint functions, the accounting settings also define how information is passed to QuickBooks and how your company’s financials are impacted.

Before adjusting these settings, it might be helpful for you to understand the various accounting options available in iPoint. Click here to get our Accounting Overview.

Deferred Revenue Accounting System: This is the checkbox to enable the advanced Deferred Revenue billing system within iPoint. Once you place a tick in this box, the right side of the screen will display a subset of RFP Accounting Settings where you can customize how the Deferred Revenue process works in your company. Click here for Deferred Revenue settings details. Note: If you are using AIA Progressive Billing, you must enable Deferred Revenue accounting.

Summarize Payment Request (Do not separate Tax/Non-tax) – Selecting this option creates a single summary payment line as non-taxable instead of calculating the taxable and non-taxable portions of the payment amount. This option is not recommended for normal accounting practices. Note: This option is not available and hidden from view when the Deferred Revenue Accounting System is enabled.

Invoice Modifiers on Delivery Invoices – By default, modifiers are an additional charge to customers that appear on standard invoices or request for payments but are not included on delivery invoices. Checking this option will include modifier calculations on delivery invoices.

Use Optional Related Customer for RFP invoice – Selecting this option will use the customer listed in the Optional Related Customer on Sales Order a sales order in place of the Customer Name ( Bill To) on RFP invoices.

Don’t show locations on Sales Order Invoices – By default, items on sales order invoice are grouped by location and have a section header || Items located in the Location ||. Checking this box removes the location section header.

Enable Change Order Progressive Invoices – This advanced feature enables change orders to be invoiced percent complete where the user can invoice a particular percentage of the change order. In essence, this enables the ability to provide multiple summary invoices per change order that match the percentage summary invoices from the original sales order.

Prompt to add time to total line item invoices – This feature is used when processing a Time & Materials type Sales Order. If you select the Total Balance Invoice > Line Item Parts Only invoice, and this feature is enabled, you will be prompted to add any unbilled labor time records to the invoice. This option allows you to bill for actual time instead of the estimated time sold in the sales order.

Use Delivery invoices without RFP – This option activates the delivery invoice portion of the Deferred Revenue Accounting process without using payment requests (RFP). That means that you can invoice customers for the actual delivered parts and labor rather than having to check off which specific parts to invoice manually.

- Note: This checkbox hides the option to use the Deferred Revenue Accounting System. Conversely, this option is not available and hidden from view when the Deferred Revenue Accounting System is enabled.

Enable Retention Tracking – Checking this box turns on the ability to withhold retention from invoices. This option is typically used by companies working with commercial contractors. Read more about retention by clicking here.

- Note: You must activate this option when using AIA Progressive Billing.

- Retainage Invoice Item – When tracking retention, iPoint needs an item to push retention calculations to QuickBooks. Create a Retention item in the Items module to define Chart of Account information. Then enter that item here in this dropdown.

Track Use Tax – Some State jurisdictions require the payment of a Use Tax in certain situations, typically for purchases made outside a company’s home state or by contractors who are installing “Real Property.” Read more about tracking use tax in the Use Tax Settings page.

Omit Change Order Details on Line Item Invoices – By default, invoices that include Change Order items show all the c/o items under a change order heading, similar to items in a room. This option will remove the change order header.

Enable Partial Percentage Line Item Invoices – This allows you to invoice a percent of the line item’s value. Invoice lines will be created for items UP TO that amount. If 20% of an item has already been invoiced and I choose 50%, iPoint will create a 30% Invoice line. If I have already invoiced 50% and choose 20%, then that line will not have an invoice line.

AIA Defaults

AIA Billing – Check this box to enable AIA billing. iPoint can generate G702 and G703 documents required for contractors using the AIA billing method.

- Note: The use of AIA billing also requires that you Enable Retention Tracking, described above.

- AIA Lines By – The billing documentation sent to your customer is presented in groups or locations of completed work as defined during the sales process. iPoint uses the Groups and Locations feature to match the lines required by your customers. Select a line item option here by choosing Locations then Groups, Groups then Locations, Location Only, or Group Only. These are defaults and can be modified on each sales order.

- Enter the default retention percentages for Completed Work and Stored Material. Retention is the amount of money a customer or contractor withholds from each invoice until the job is completed.